Theme Parks: Deep Dive

Share

|

|

|

|

Intro |

|

|

In 2009, Blackstone made one of its most distinctive and profitable investments to date - the acquisition of the renowned amusement park chain, SeaWorld. At the time of the acquisition, SeaWorld had just been spun off from Anheuser-Busch - the beer company had owned Busch Gardens (part of SeaWorld’s portfolio) as part of its legacy business. |

|

|

The sale presented Blackstone with a unique opportunity to capitalize on SeaWorld’s untapped potential. Blackstone even celebrated the acquisition by welcoming two Magellanic penguins from SeaWorld into their 345 Park Ave office. |

|

|

Blackstone ultimately sold their stake in SeaWorld eight years later, posing a compelling question to investors and industry analysts alike - can amusement parks make good investments? |

|

Business Overview |

|

|

Theme parks are masterful revenue-generating machines, utilizing a variety of streams to ensure an unforgettable experience for visitors, and a prosperous future for themselves. |

|

|

At the heart of their revenue strategy lies the sale of admission tickets. Whether enticing visitors for a day or embracing their loyal fans with season passes, tickets are a theme park’s bread and butter. |

|

|

While ticket sales make up a significant portion, accounting for roughly 50% of a park's revenue, the remaining financial lifelines flow from a captivating array of sources such as merchandise, food sales, and premium rides and activities. |

|

|

And those cheesy gift shops and tourist traps work like magic. By offering clothing, toys, and collectibles, theme parks transform ordinary souvenirs into mementos that rake in substantial additional revenue. And if you've ever marveled at the exorbitant prices theme parks charge for the photos they capture of you during those exhilarating rides, it becomes abundantly clear that the potential for theme parks to monetize their offerings knows no bounds. |

|

|

Moreover, food becomes an essential pillar of revenue for many theme parks. Take Disney World for instance, boasting over 200 restaurants on-site. |

|

|

And many parks offer premium services that allow visitors to elevate their adventure. Take Disney's renowned 'FastPass' system, for example. By offering the option to pay extra to skip the line and enjoy expedited access to popular rides, theme parks tap into the desires of their patrons, creating an opportunity to generate additional revenue while granting a coveted sense of exclusivity. |

|

|

|

History |

|

|

Theme parks have been around for a minute, but Disney changed the game when Disneyland opened in California in 1955. Soon after, Six Flags opened in Texas in the 1960s, and Disney World opened in Florida in the 1970s. |

|

|

The 1970s and 1980s saw a proliferation of theme parks across the United States. Notable examples include Busch Gardens, SeaWorld, Knott's Berry Farm, and Hersheypark. |

|

|

In the 2000s and beyond, several new theme parks emerged, such as Universal Studios Hollywood's The Wizarding World of Harry Potter and The Wizarding World of Harry Potter at Universal Orlando Resort. |

|

|

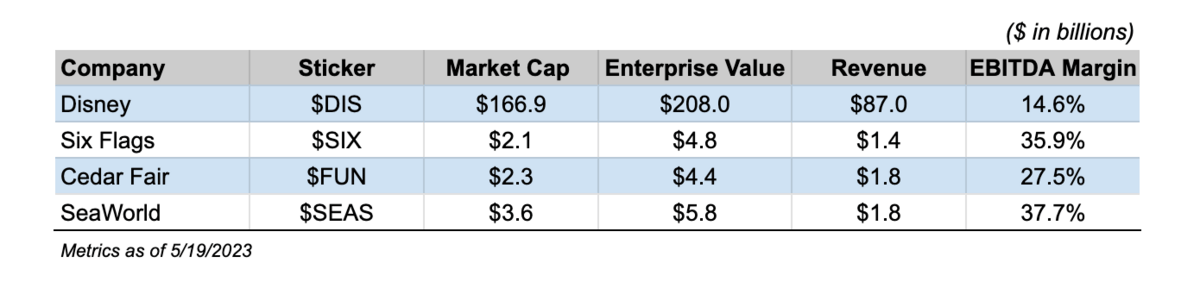

Here are some publicly traded companies that operate theme parks: |

|

|

1. The Walt Disney Company (NYSE: DIS) |

|

|

2. Comcast Corporation (NASDAQ: CMCSA) - Comcast owns Universal Parks & Resorts, which operates Universal Studios. |

|

|

3. Six Flags Entertainment Corporation (NYSE: SIX) - Six Flags is the largest regional theme park operator in the world. |

|

|

4. Cedar Fair Entertainment Company (NYSE: FUN) - Cedar Fair owns and operates amusement and water parks, including Cedar Point in Ohio, Knott's Berry Farm in California, and Canada's Wonderland. |

|

|

5. SeaWorld Entertainment, Inc. (NYSE: SEAS) - SeaWorld operates marine-themed parks, including SeaWorld Orlando, SeaWorld San Diego, and Busch Gardens. |

|

|

|

SeaWorld |

|

|

|

|

In this deep-dive we decided to focus on SeaWorld for several reasons. First and foremost, SeaWorld has been a solid pick for investors over the past few years. SeaWorld is up 305% in the past 3 years (the S&P 500 is up 46%). |

|

|

Secondly, SeaWorld provides a unique lens for investors as it was both private equity owned by Blackstone and now is a publicly-traded company. |

|

|

SeaWorld was hampered by animal cruelty scandals in the early 2010s, causing attendance to plummet. But the theme park company has cleaned up its act, and is now even eyeing international expansion. SeaWorld wants to build more on-site hotels like Disney World, and the company wants to open the largest aquarium in the world in Ahu Dhabi. |

|

|

SeaWorld Financial History |

|

|

|

|

Over the past few years, SEAS has undergone significant transformations, enabling it to stand shoulder-to-shoulder with industry giants like Disney and Universal. With a portfolio of twelve theme parks spanning the United States and a range of captivating brands including SeaWorld, Busch Gardens, Discovery Cove, Sesame Place, and Water Parks, SEAS has cemented its position as a powerhouse in the theme park realm. |

|

|

SEAS has demonstrated a resilient business strategy that yields favorable results even during challenging times. Instead of solely focusing on increasing attendee numbers, the company has successfully pursued a strategy of enhancing per capita spending, while still aiming to attract a larger proportion of international and group-organized visitors. This approach can be attributed to SEAS' increased investment in facilities, technologies, and strategic pricing strategies for merchandise, food, and admission fees. |

|

|

While there is already considerable success in increasing per capita spending, there remains significant untapped potential if the company can regain its historically high attendance numbers. |

|

|

Central to SEAS' success is its ability to diversify revenue streams. While park admission fees serve as the foundation, the company has expanded its offerings to include food, clothing, and merchandise sales, with in-park spending accounting for a remarkable 43% of total revenue in FY21. By catering to visitors' desires for memorable experiences and exclusive souvenirs, SEAS ensures a steady flow of income while fostering a deeper connection between guests and the brand. |

|

|

An intriguing aspect of SEAS' business model is its strategic pricing approach. In an industry where ticket prices continue to rise, SEAS has mastered the art of capturing the value of its attractions. A one-day visit to a SEAS park can cost an individual an average of a staggering $174.98, encompassing not only admission but also a single meal, drink, and parking spot. By offering comprehensive packages that cater to visitors' needs, SEAS positions itself as a premier destination, enticing customers with the promise of a complete and fulfilling experience. |

|

|

SEAS' determination to solidify its position in the market is evident through its strategic maneuvers. The unsuccessful takeover bid of Cedar (FUN) last year, valued at $3.4 billion, showcased SEAS' ambition to expand its reach and further dominate the regional theme park landscape. By aggressively pursuing growth opportunities, SEAS has proven its commitment to constant evolution and its relentless drive to capture market share. |

|

Bulls |

|

|

|

|

|

|

|

|

2. Resurgence of Group/International Visitors |

|

|

|

|

3. New Investments |

|

|

|

|

4. International Expansion |

|

|

|

|

|

Bears |

|

|

|

|

|

|

2. Staff Shortages |

|

|

|

|

3. Weather Risks |

|

|

|

|

4. Financial Vulnerability |

|

|

|

Conclusion |

|

|

Coming off of Covid, an animal rights scandal, and a couple of years of underutilization, SEAS has embarked on exciting new ventures that enhance its growth prospects. The company's first international park opening in Abu Dhabi showcases its expansion into new markets and signifies its commitment to global expansion. Additionally, SEAS has been engaged in ongoing discussions regarding the establishment of onsite hotels, which would create new revenue streams and enhance the overall visitor experience. |

|

|

Given these factors, we find compelling reasons to adopt a bullish stance on SEAS. The company's ability to drive per capita spending, potential for regaining high attendance levels, and its expansion into international markets and hotel ventures all contribute to a positive outlook for the stock. By capitalizing on its solid business strategy and seizing these growth opportunities, SEAS has the potential to deliver significant returns for investors. |

|