Ye Says Nay

Share

|

|||||||||||||

|

|||||||||||||

|

|

|||||||||||||

Intro |

|||||||||||||

|

|||||||||||||

|

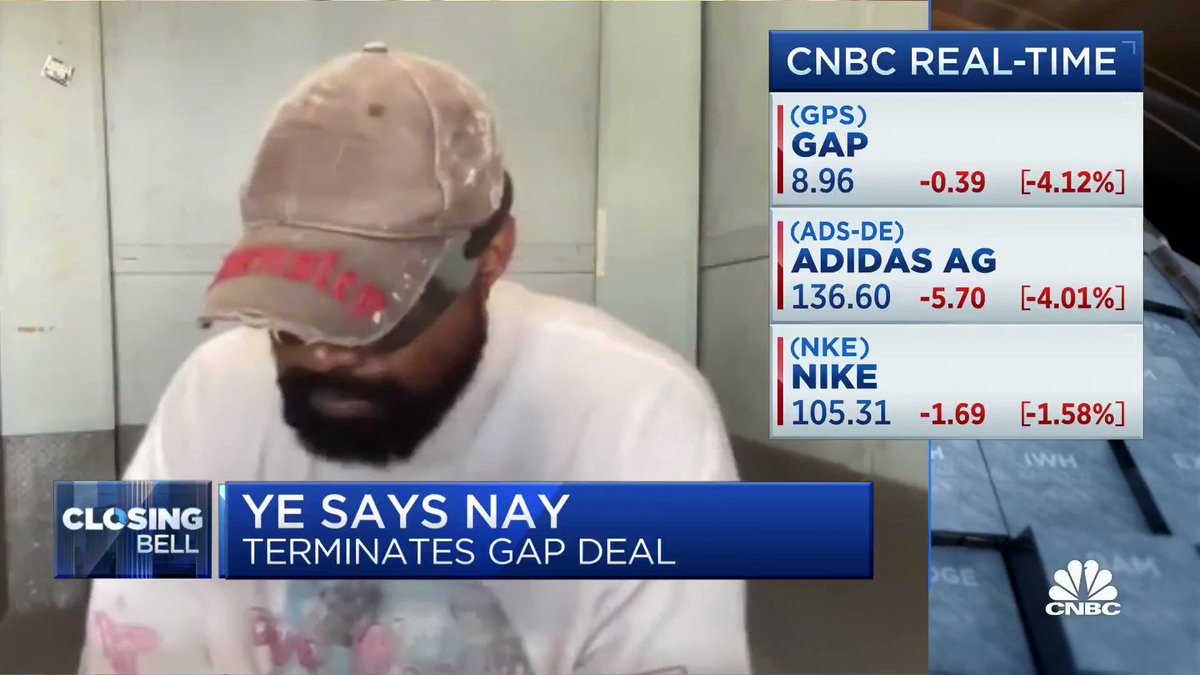

When this year started, Kanye West & Adidas had an ongoing partnership to develop West’s ”Yeezy-branded footwear and streetwear” that appeared to be moving along well. |

|||||||||||||

|

Not anymore. |

|||||||||||||

|

In 2016, West & Adidas signed a contract that has apparently paid West somewhere in the range of $191 million in 2020 alone in royalties based on his designs and creations. |

|||||||||||||

|

Fast forward to these last few months and Kanye has been slamming Adidas on social media for not following through on the promises they made him - namely, not opening the “Yeezy-branded” stores they had promised, or giving him more creative control and even stealing his designs for use in other areas. |

|||||||||||||

|

Partnerships like this one have taken footwear to a whole new level by combining big name celebrities and fashion designers with footwear brand special designs. |

|||||||||||||

|

|||||||||||||

|

In fact, these special designs and limited editions have driven the explosion of footwear as an asset class. |

|||||||||||||

|

|||||||||||||

|

Last year, the resale market for shoes was estimated to stand at $6 billion in annual sales. |

|||||||||||||

|

Second-hand markets like this have driven primary market value for big name brands like Nike and Adidas into more than just another basketball or tennis shoe. |

|||||||||||||

|

But blow-ups like what we have seen between West & Adidas add more value for rivals, like Nike, whose brand draws in more and more followers each year, instead of driving them away. |

|||||||||||||

|

Nike has a market cap of $165 billion and the “close” second, Adidas, barely comes up to Nike’s knee with a $25 billion market cap. |

|||||||||||||

|

|||||||||||||

|

Let’s dig into Nike and see why they are so much larger (and better?) than Adidas. |

|||||||||||||

Universe |

|||||||||||||

|

Let’s start with the reach of both Adidas and Nike because what you might think is that Nike has a reach that far surpasses Adidas just based on the market cap we highlighted earlier. |

|||||||||||||

|

But in fact – they both have an incredibly similar reach. Adidas may have a larger physical presence even. |

|||||||||||||

|

Nike ships its products to more than 190 countries across the globe. Operating 1,000 Nike stores directly and another 6,000 operated by franchisees. |

|||||||||||||

|

Adidas ships to over 150 countries across the globe. They have more distribution points than Nike by a wide margin, operating over 2,100 stores directly, franchising another 15,000, and selling in another 150,000 wholesale locations. |

|||||||||||||

|

Hearing that would make anyone stop and wonder why Nike is so much larger and more valuable than Adidas, right? |

|||||||||||||

|

It’s all about the brand name. |

|||||||||||||

|

And Nike has a global brand that is recognized in every single market. And that brand recognition has massive intangible value. |

|||||||||||||

|

That intangible value isn’t something you can see on their balance sheet. There is no “official” dollar amount tied to the value of the Nike swoosh. But when you see that swoosh you know there is quality, value and price associated with that shoe. |

|||||||||||||

|

Adidas has brand recognition, there is no doubt about that. We all know the three stripes. But is that brand connected with the same level of value that we attribute to Nike? |

|||||||||||||

|

|||||||||||||

|

But they don’t instill the same value or reaction as the Nike Swoosh. |

|||||||||||||

|

And that’s the kicker – so let’s dive into Nike! |

|||||||||||||

Nike |

|||||||||||||

|

Nike is the largest athletic footwear brand in all major categories and in all major markets, dominating shoe styles in running and basketball. They raked in an impressive $46 billion in revenue in their 2022 Fiscal Year. |

|||||||||||||

|

That sales number has grown consistently, each year except for 2020, going back to 2010 at a 7.16% CAGR over the last 13 years. |

|||||||||||||

|

For a company to continually grow topline revenue at such a consistent pace is very impressive, but add to that the fact that they were also able to grow their net income by a staggering 9.28% CAGR over the same time period. |

|||||||||||||

|

What about investors? How did stock price performance impact investors who bought $NKE in 2010 and held it through May of 2022? |

|||||||||||||

|

Stockholders would have massively outperformed the market over that period. In fact, $NKE stock price appreciated over 6.2x over that 13-year period, excluding dividends… |

|||||||||||||

|

|||||||||||||

|

But what is it about Nike that makes them such a powerhouse in the footwear industry and primo investment? |

|||||||||||||

|

In 2020, Nike stepped up its game in a big way when it brought in the new CEO, John Donahue, and doubled down on their commitment to its initiative entitled the “Triple Double.” |

|||||||||||||

|

While I am sure all of you recognize what a triple-double means in basketball, you might be asking yourself how does this apply in business? |

|||||||||||||

|

Nike, even though they had a minor setback in sales growth in 2020, was able to execute incredibly well on their initiative to bring their products direct to consumers. No more utilizing sales channels where they were not front and center to the end consumer. |

|||||||||||||

|

With the rise of e-commerce during COVID, and the focus that Nike had on being able to create and own the environment in which their shoes were sold, things started to change in a big way – now they wanted to focus on improving their speed in innovation and cutting costs. |

|||||||||||||

|

The Triple Double encompasses three areas of growth that Nike has been focusing on over the last 5-8 years and shows their focus on improving these key areas: 1) Speed to market, 2) Innovation and 3) Direct-to-consumer acceleration. |

|||||||||||||

|

They wanted to improve their ability to innovate and develop new lines of shoes that will be in high demand and be of the highest quality. |

|||||||||||||

|

They also wanted to shorten the time it would take them to create these new product lines and get them to market. |

|||||||||||||

|

And finally, they wanted to be able to bring those innovations, developed at a lightning-fast pace, directly to their consumers in a manner that they owned and operated. |

|||||||||||||

|

In 2017, Nike had around 30,000 retail partners worldwide, selling their shoes in a multitude of different environments. By 2019, their focus on controlling this environment proved itself out by whittling that list down to just 40 partners. |

|||||||||||||

|

The rise of e-commerce in 2020 allowed Nike to further focus on their ability to deliver products directly to consumers and in 2022, $10 billion in sales were generated by Nike’s online platform – a staggering increase from the $1.5 billion in online sales generated in 2015. |

|||||||||||||

|

Over this period of focus on innovation, speed, and improving their direct connection with the consumer, Nike has hit every three-point shot, lay-up, and rebound. |

|||||||||||||

|

Focusing their efforts on making better brand quality and limiting the outsourcing of sales has only made them more valuable in the eyes of the consumer. |

|||||||||||||

|

Scarcity drives value, right? |

|||||||||||||

|

Right now, no one bats an eye at a $150 or $200 pair of Nikes and some collectors are paying even more! But the question has never been: are these Nike’s worth $200? |

|||||||||||||

|

Because the answer has always been: Yes! |

|||||||||||||

|

Brand Recognition |

|||||||||||||

|

The other area to dive into in athletic footwear is brand sponsorship and endorsements. Even for the non-athletic types among us (what? I like weights. Not team events!), the name Michael Jordan means something. |

|||||||||||||

|

|||||||||||||

|

It means the greatest basketball player of all time. |

|||||||||||||

|

Lebron James. Kobe Bryant. Kevin Durant. Serena Williams. Rafael Nadal. Tiger Woods. |

|||||||||||||

|

|||||||||||||

|

The list goes on and on with names that just about anyone can recognize and attribute greatness to. |

|||||||||||||

|

And these are all names of athletes that are sponsored by Nike. |

|||||||||||||

|

Nike has a powerful pull in this space. Athletes want to be associated with powerhouses like Nike. Not only because they get paid to do so (Lebron James signed a contract to be sponsored by Nike in 2015 where he gets paid $30 million per year until 2048) but because of what that association means. |

|||||||||||||

|

Back in 2003, Lebron James was offered more money to be sponsored by Reebok but he turned them down to sign with Nike. Turning Reebok down, even back then when Lebron was less of a well-known name than today, decimated the foothold in basketball that Reebok was building. |

|||||||||||||

|

This sounds eerily similar to the news we mentioned above with Kanye announcing his intent to end his contract with Adidas. While he is not an athlete, he is an extremely public figure that consumers are drawn to. |

|||||||||||||

|

Does this mean the slow decline of Adidas? |

|||||||||||||

|

These types of moves are bad news for brand image and in the clothing and retail space – the brand is everything. |

|||||||||||||

|

Athletes have a significant impact on consumer tendencies and when the best of the best only want to do business with one brand – you can believe that consumers will follow suit. |

|||||||||||||

|

Even after Kobe Bryant passed away (RIP) his association with Nike remains strong and his signature shoe is worn by more NBA athletes than any other. |

|||||||||||||

|

Business Operations and Investment |

|||||||||||||

|

Underlying everything we have discussed is a business that has continued to generate cash, make savvy investment decisions, and stay ahead of the pack for decades. |

|||||||||||||

|

Two prime areas that showcase this are Nike’s return on investment and their ability to generate such high levels of cash flow to support a generous dividend as well as an aggressive stock buyback plan. |

|||||||||||||

|

Look at Converse. |

|||||||||||||

|

Nike bought Converse in 2003 after they had announced bankruptcy. The company was generating only $200 million in annual sales and Nike paid $305 million to acquire the business. |

|||||||||||||

|

A 1.5x multiple of sales is a scary good price. |

|||||||||||||

|

Fast forward to 2022: Converse is generating $2.3 billion in sales and $700 million in operating profits. |

|||||||||||||

|

Converse sales have increased 11.2x in 20 years under the guidance and ownership of Nike. |

|||||||||||||

|

Nike spent next to nothing on Converse – in a year where Nike was generating $10 billion in sales and $732 million in free cash flow, they took a tiny bet and it paid off immensely. |

|||||||||||||

|

In fact, when looking closer at Nike’s Return on Invested Capital, the return they are able to generate is an impressive +37%. This number is even more impressive when you factor in the fact that Nike’s working average cost of capital (WACC) is only 9%. |

|||||||||||||

|

WACC is a good hurdle to measuring a company’s ability to generate returns for its investors. If Nike is looking at opportunities to invest in projects with their own capital, the WACC would be their minimum investment to justify spending excess capital instead of giving it back to shareholders. |

|||||||||||||

|

In dollar terms, if Nike generates a 15% return on investment and it costs them 9% working capital, that translates to a shareholder value add of $0.06 for every $1.00 invested in the stock. |

|||||||||||||

|

What Nike has produced already in the past shows us that Nike can produce a return closer to $0.30 for every $1.00 invested. |

|||||||||||||

|

This is wildly impressive – the company management has made smart decisions in allocating their capital in ways that grow the business and create immense value for shareholders. |

|||||||||||||

|

Key Metrics: |

|||||||||||||

|

Current Price (as of 9.16.22): $103.83 |

|||||||||||||

|

|||||||||||||

|

NTM metrics: |

|||||||||||||

|

|||||||||||||

Conclusion/Recommendation: |

|||||||||||||

|

Right now, 34 Wall Street analysts cover Nike, with the majority placing a BUY/OVERWEIGHT rating on the company. The average price target for the next 12 months stands at $130, which is a 21% gain. |

|||||||||||||

|

Nike started the year with a stock price of $166, which means it has dropped 35% YTD. This is much harder than the broader market, which is only down 17%. |

|||||||||||||

|

Keeping this in mind, along with Nike’s incredible ability to execute on their Triple Double plan so far, we think the optimism generally seen from Wall Street analysts is warranted here. |

|||||||||||||

|

For a company that appears to have a solid foothold in the space and a very strong balance sheet, fears of a recession appear to float right past Nike. |

|||||||||||||

|

With that in mind, thinking that Nike can get back to 2021 numbers should be pretty clear. And that calls for a 60%+ return off today’s numbers. |

|||||||||||||

|

It looks like Nike should have an easier time regaining their 2022 losses than Adidas if Kanye and the “Yeezy” brand walk off the court… |

|||||||||||||

|